By Walker Deibel

Contrary to popular belief, most businesses in the world don’t have a significantly unique offering. Instead, it’s more common to rely on differences from competitors. These sometime fall in areas like market positioning, marketing channels, key relationships, equipment, or geography. Knowing what makes a company different is more important, especially in mature markets, than what makes it better.

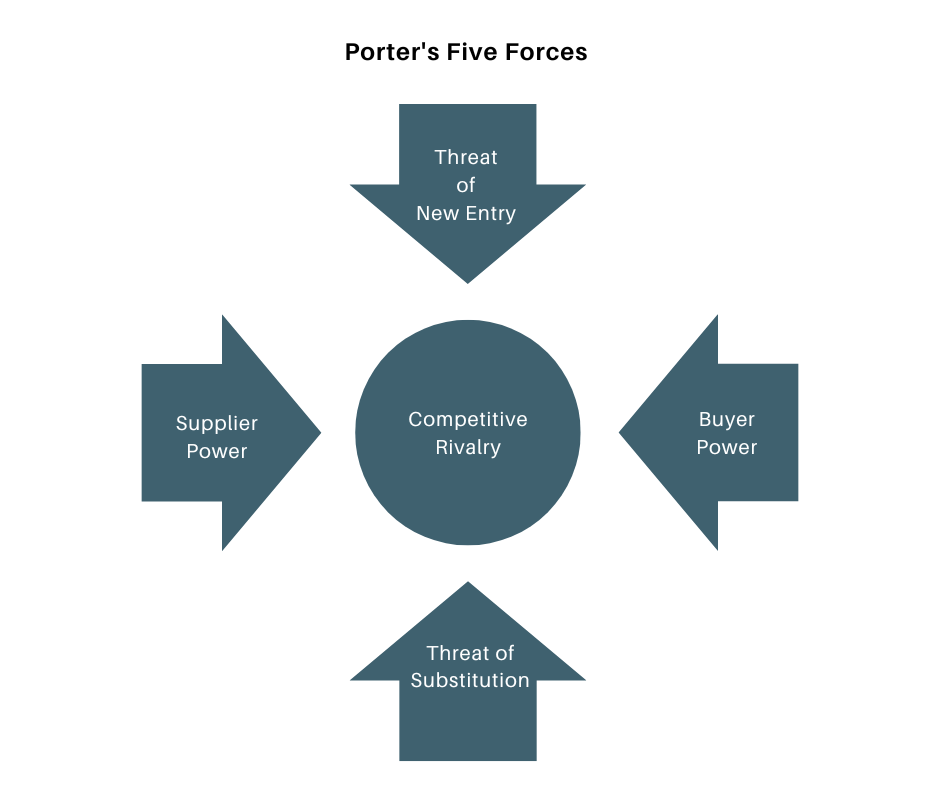

Understanding the business model will help outline the existing strengths, threats, and trends within an industry and a business. We’ll look at Porter’s Five Forces and the Lifecycle of Industry as tools for highlighting the economics of an industry and the differences that exist in a specific company as a result.

PORTER’S FIVE FORCES

Michael Porter is a revered economist and corporate strategist from Harvard University who literally wrote the books on Competitive Strategy and Competitive Advantage. He first introduced his Five Forces model in Harvard Business Review in 1979. Today, they represent a cornerstone of corporate strategy education in business schools and board rooms across the globe.

Porter’s Five Forces provide a framework for identifying where the power lies in the supply chain, where the threats exist in an existing business model, and where the strengths of a company’s value proposition can be found.

By considering the overall industry, and then a specific business, as it applies to each force, you can begin to understand the state of the industry and the position of the company within that industry.

THE THREAT OF NEW ENTRANTS

The threat of new entrants refers directly to Warren Buffet’s concept of the “moat.” In other words, does the company provide something that allows it to fend off new companies from entering the market and taking existing market share? Buffet’s long-used example of the ideal business being the only toll road across a river might apply as a good analogy here. Spend time identifying the barriers to entry that exist. If someone else wanted to start a similar business, what would keep them out?

The threat of new entrants is typically kept at bay with competitive tools such as differentiation, brand equity, economies of scale, switching costs, cost of starting up, access to distribution channels, geographic restrictions, or the new favorite, network effects. Does the target business hold any protection from this threat? How strong is it?

THE THREAT OF SUBSTITUTES

The threat of substitutes refers to analyzing the value the product or service has to the customer. Is there a potential easier way to accomplish the same or similar goal for the customer? This points not to direct competition over the same product, but rather to understanding the value being received by the customer and identifying what else may provide that benefit. It’s easy to think about new technologies moving in and eating market share, such as cell phones overtaking landlines or tablets eating away at laptops. I try to consider the offering at the highest level; for example, television and books both provide home entertainment, so understanding the trend surrounding substitutes at this level could prove insightful, and perhaps enough to develop a strategy around diversification if it made sense.

BUYER POWER

Consider the power customers have to drive prices down. This will show you how much “buyer power” exists in an industry. If there are a few large buyers and many fragmented suppliers, this gives particular strength to the buyers to put suppliers in direct competition against each other in a race to the lowest price. This concept is typically thought of as commoditization. This industry might be ripe for either a disruptive technology or consolidation play – either of which could be executed by an acquisition entrepreneur with the right plan.

SUPPLIER POWER

Supplier power is the opposite of buyer power. It speaks to how easy it is for the company’s suppliers to increase prices, which in turn increases cost of goods sold and reduces gross margins. How many suppliers are there? How unique is their product? How difficult is it to switch? Or, in today’s world, could the supplier cut out the target business altogether and sell directly to buyers online? How strong is the distribution channel?

COMPETITION

Industry rivalry is likely the core of where your research will be for this phase. Understanding who the competitors are, how competitive the market is, the position of each of the competing entities, and what their value proposition is will lead you to an understanding of all the players. Look for quantifiable data showing trends in the industry. Get industry reports and comparable company financials if you can. This will help you understand the performance in the industry new opportunities or differentiators.

APPLYING THE FORCES

As you apply Porter’s Five Forces to the acquisition target and its industry, a picture will emerge that will provide the foundation for how attractive the business is in its current state. As you review, ask yourself what new management could do to leverage or change any threats or opportunities.

In the same regard, acquiring a business has inherent risk. By applying the forces, you should be able to clearly identify what the risks are with a specific business and whether you are comfortable with the level of risk or not.